EnGold Cuts 1.43 % CuEq Over 22.4 m Within 38.60 m Interval Grading 1.05 % CuEq New Drilling Discovers G1 Extension to the Southeast with 24 m Intercept Awaiting Assay

For Immediate Release. October 6, 2020. Vancouver, BC. David H. Brett, President & CEO, EnGold Mines Ltd., (TSX-V: EGM, “EnGold” or the “Company”) reports broad intervals of high-grade copper assays from two drill holes at the G1 Copper Zone. Also, recently completed hole G20-49 on the southern edge of G1 has encountered mineralization over much thicker than expected intercepts.

The G1 Copper Zone is located on EnGold’s 100% owned, multi-deposit Copper Gold Lac La Hache Property in the Cariboo region of BC.

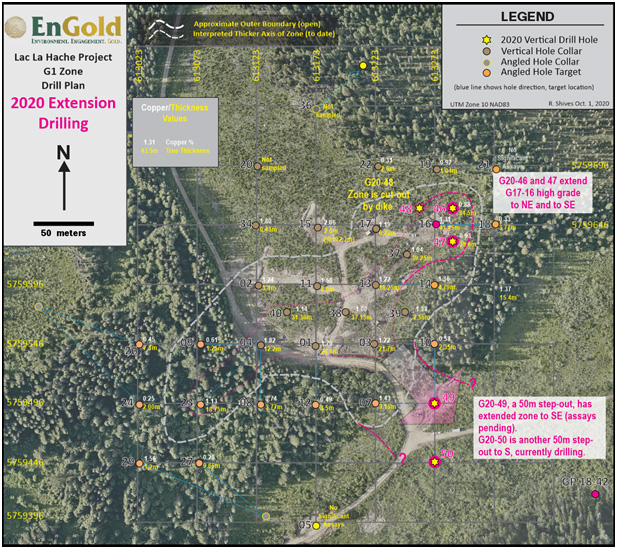

Hole G20-46, located 20 m northeast of hole G17-16, cut 15.43 m grading 1.6% Copper Equivalent (CuEq)* within a broader 34.46 m mineralized interval grading 1.02 % CuEq. Hole G20-47, located 20 m southeast of G17-16, cut 22.4 m grading 1.43 % CuEq within a broader 38.6 m interval grading 1.05 % CuEq. Hole G20-48, collared 20 m northwest of G17-16, encountered a narrow vertical intrusive dike throughout the expected mineralized interval and was not sampled. Holes G20-46 and G20-47 have successfully confirmed extension of mineralization encountered in G17-16, which cut 43.45 m of 1.54% CuEq. A full table of the results is inserted below. All reported intervals are believed to be true widths.

Table 1: Assays and calculated copper equivalent values for selected intervals, G1 Zone.

| DDH | From (m) | To (m) | Interval (m) | Cu (%) | Au (g/t) | Ag (g/t) | Fe (%) | Copper Eq.* |

|---|---|---|---|---|---|---|---|---|

| New Sept 2020 Drill Results | ||||||||

| G20-46 | 305.77 | 340.23 | 34.46 | 0.88 | 0.12 | 2.72 | 20.65 | 1.02 |

| including | 305.77 | 321.20 | 15.43 | 1.37 | 0.20 | 4.22 | 32.03 | 1.60 |

| including | 339.50 | 340.23 | 0.73 | 1.84 | 0.23 | 8.10 | 30.20 | 2.14 |

|

|

||||||||

| G20-47 | 293.80 | 332.40 | 38.60 | 0.93 | 0.10 | 2.84 | 20.03 | 1.05 |

| including | 293.80 | 298.40 | 4.60 | 1.29 | 0.11 | 4.36 | 26.91 | 1.44 |

| including | 310.00 | 332.40 | 22.40 | 1.29 | 0.13 | 1.76 | 24.71 | 1.43 |

| including | 310.00 | 318.70 | 8.70 | 1.92 | 0.21 | 6.78 | 34.17 | 2.19 |

| including | 312.00 | 316.00 | 4.00 | 2.38 | 0.25 | 9.15 | 37.70 | 2.71 |

| Copper Equivalent Grades for Selected Previously Announced Drill Results | ||||||||

| G16-01 | 337.30 | 363.87 | 26.57 | 1.76 | 0.27 | 10.29 | 35.80 | 2.12 |

| including | 343.00 | 357.00 | 14.00 | 2.09 | 0.27 | 12.34 | 36.40 | 2.48 |

| 416.00 | 421.66 | 5.66 | 1.14 | 0.23 | 5.07 | 19.70 | 1.41 | |

| including | 418.53 | 419.53 | 1.00 | 4.49 | 0.94 | 17.10 | 44.00 | 5.55 |

| G17-03 | 337.30 | 359.00 | 21.70 | 1.22 | 0.17 | 5.96 | 30.06 | 1.44 |

| including | 343.00 | 349.00 | 6.00 | 1.76 | 0.16 | 8.00 | 34.23 | 2.00 |

|

|

||||||||

| G17-04 | 336.00 | 348.20 | 12.20 | 1.82 | 0.41 | 9.96 | 32.49 | 2.31 |

| including | 336.00 | 342.00 | 6.00 | 2.18 | 0.46 | 12.13 | 34.87 | 2.74 |

| 423.83 | 425.12 | 1.29 | 0.70 | 0.06 | 5.50 | 21.30 | 0.82 | |

| G17-07 | 351.25 | 357.3 | 6.05 | 1.01 | 0.18 | 8.02 | 24.25 | 1.27 |

| including | 352.5 | 355.65 | 3.15 | 1.43 | 0.31 | 12.60 | 28.18 | 1.86 |

| G17-09 | 288.00 | 298.55 | 10.55 | 1.10 | 0.27 | 5.53 | 5.81 | 1.41 |

| including | 289.55 | 294.00 | 4.45 | 2.02 | 0.57 | 10.31 | 6.21 | 2.66 |

| including | 289.55 | 290.00 | 0.45 | 12.35 | 4.48 | 66.40 | 13.85 | 17.23 |

| 332.75 | 334.00 | 1.25 | 0.61 | 0.03 | 2.80 | 9.60 | 0.67 | |

|

|

||||||||

| G17-11 | 321.96 | 333.00 | 11.04 | 1.16 | 0.12 | 6.19 | 27.44 | 1.34 |

| including | 323.00 | 331.00 | 8.00 | 1.50 | 0.16 | 7.73 | 31.58 | 1.73 |

|

|

||||||||

| G17-13 | 318.75 | 337.00 | 18.25 | 1.22 | 0.14 | 5.27 | 26.70 | 1.41 |

| including | 328.00 | 334.00 | 6.00 | 1.92 | 0.18 | 8.23 | 30.27 | 2.18 |

|

|

||||||||

| G17-14 | 309.56 | 314.35 | 4.79 | 1.36 | 0.14 | 7.24 | 26.60 | 1.57 |

| including | 311.00 | 313.65 | 2.65 | 1.97 | 0.20 | 10.82 | 34.95 | 2.28 |

| G17-16 | 293.00 | 336.45 | 43.45 | 1.31 | 0.20 | 4.06 | 31.14 | 1.54 |

| including | 293.00 | 296.80 | 3.80 | 2.01 | 0.23 | 6.09 | 34.16 | 2.29 |

| including | 302.00 | 326.00 | 24.00 | 1.67 | 0.29 | 5.09 | 34.55 | 1.99 |

| G17-17 | 250.00 | 281.00 | 31.00 | 0.46 | 0.05 | 3.26 | 7.78 | 0.54 |

| including | 250.00 | 264.00 | 14.00 | 0.48 | 0.12 | 3.26 | 8.58 | 0.63 |

| including | 269.00 | 281.00 | 12.00 | 0.54 | 0.06 | 2.12 | 7.66 | 0.62 |

| 308.14 | 323.22 | 15.08 | 0.72 | 0.11 | 3.28 | 21.23 | 0.86 | |

| including | 317.00 | 323.22 | 6.22 | 1.19 | 0.18 | 5.84 | 27.80 | 1.42 |

|

|

||||||||

| G17-23 | 351.20 | 369.95 | 18.75 | 1.13 | 0.14 | 5.55 | 26.23 | 1.32 |

| including | 351.20 | 356.05 | 4.85 | 1.42 | 0.15 | 9.13 | 37.48 | 1.66 |

| including | 352.00 | 354.00 | 2.00 | 1.69 | 0.20 | 13.50 | 36.70 | 2.03 |

| including | 361.76 | 363.05 | 1.29 | 5.44 | 0.54 | 19.80 | 30.80 | 6.16 |

| G17-37 | 298.60 | 337.85 | 39.25 | 1.04 | 0.11 | 5.21 | 24.53 | 1.20 |

| including | 302.00 | 306.92 | 4.92 | 1.62 | 0.18 | 7.73 | 33.56 | 1.87 |

| including | 311.00 | 312.80 | 1.80 | 1.54 | 0.19 | 6.70 | 16.45 | 1.79 |

| including | 321.00 | 329.00 | 8.00 | 2.01 | 0.20 | 11.70 | 37.28 | 2.33 |

| G17-38 | 318.75 | 355.88 | 37.13 | 1.00 | 0.16 | 4.41 | 26.35 | 1.20 |

| including | 332.12 | 355.88 | 23.76 | 1.37 | 0.24 | 6.23 | 36.70 | 1.66 |

| including | 340.00 | 344.00 | 4.00 | 2.15 | 0.58 | 8.10 | 36.45 | 2.78 |

| G17-39 | 310.20 | 320.90 | 10.70 | 0.42 | 0.05 | 1.87 | 17.08 | 0.49 |

| including | 310.20 | 312.30 | 2.10 | 1.13 | 0.13 | 5.40 | 27.00 | 1.31 |

|

|

328.30 | 335.55 | 7.25 | 0.69 | 0.08 | 3.25 | 18.76 | 0.80 |

| including | 333.00 | 335.55 | 2.55 | 1.38 | 0.17 | 6.94 | 31.33 | 1.61 |

|

|

||||||||

| G17-40 | 321.94 | 376.88 | 31.36 | 1.14 | 0.28 | 6.89 | 24.31 | 1.48 |

| including | 332.63 | 346.95 | 14.32 | 1.71 | 0.48 | 10.63 | 32.40 | 2.27 |

| including | 350.85 | 353.30 | 2.45 | 2.21 | 0.36 | 14.00 | 37.86 | 2.70 |

“We are providing copper equivalent grades for the G1 Copper zone in light of the sharp rise in the prices of gold and silver since discovery of the deposit in 2017,” said EnGold VP of Exploration Rob Shives, P.Geo. “The added value varies, but overall we see about a 20-25% increase at G1 relative to copper-only grades, as can be seen in the selected past results in the table. We have also asked SRK to express the pending resource calculation in copper equivalent.”

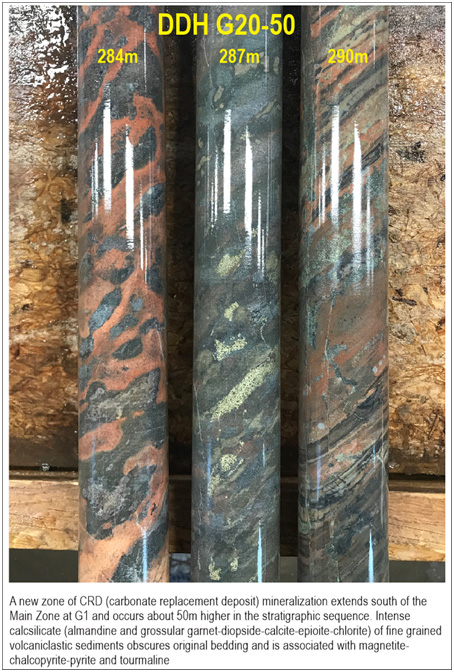

Hole G20-49 was collared to test a previously undrilled area in the southeastern side of G1 Zone (see map insert), where previous drilling suggested the zone narrows. Visual results in hole G20-49 indicate a possible new extension to south and east, as well as broad zones of a new-style of magnetite-chalcopyrite-pyrite carbonate replacement, within silty-sandy bedded, calcsilicate altered volcaniclastic sediments lying stratigraphically above the main zone at G1. Assays are pending for G20-49. In light of the encouraging looking material in G20-49, a 50 m step out hole to the south is underway as Hole G20-50. The upper part of this hole has intersected mineralization earlier than expected at about 50 m above the projected main zone stratigraphy. See photo of these drill cores, below.

“While expanding G1 high copper grades to the northeast is very encouraging, the potential for a new, broad extension to the south is even more significant,” said EnGold President & CEO David Brett. “We look forward to further drill results to the south, and are encouraged that our exploration model suggests potential for multiple G1-style zones along a multi-kilometer trend.”

The G1 Copper Zone is located 1.8 km south of the Spout Copper Deposit, and 5 km northwest of the Aurizon Gold Deposit, all within a 10 km prospective trend at the core of the Company’s 100% owned Lac La Hache property in the Cariboo region of British Columbia. All results reported are believed to be approximately true width. Further drilling at G1 is planned.

*Assumptions used in USD for the copper equivalent calculations were metal prices of $3.00/lb. Copper, $1,900/oz Gold, $23/oz Silver, and recovery is assumed to be 100% as no metallurgical test data is available. The following equation was used to calculate copper equivalence: CuEq = Copper (%) + (Gold (g/t) x 0.9240) + (Silver (g/t) x 0.0112). No value has yet been assigned to the considerable Magnetite concentrations within the G1 Zone.

About EnGold

EnGold (www.engold.ca) is focused on exploring its 100% owned mineral property located near the town of Lac La Hache in BC’s prolific Cariboo mining region. EnGold’s corporate philosophy rests on three interdependent pillars: Environment, Engagement and Gold. Through sound environmental stewardship, commitment to transparent engagement with local communities, the Company is dedicated to driving shareholder and stakeholder value by discovering and developing mineral resources.

Rob Shives P.Geo., VP Exploration and a Qualified Person as defined under National Instrument 43-101, has reviewed and approved the technical content of this release.

Engold Mines Ltd.

Per/

David Brett, MBA

President & CEO

Contact: David Brett, 604-682-2421 or david@engold.ca

Forward Looking Statements: The information in this news release contains forward looking statements that are subject to a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those anticipated in our forward looking statements. Factors that could cause such differences include: changes in world commodity markets, equity markets, costs and supply of materials relevant to the mining industry, change in government and changes to regulations affecting the mining industry and failure to obtain regulatory approval in a timely manner. Forward-looking statements in this release include statements regarding plans to raise financing for operations, future exploration programs and operation plans and anticipated timing for completion of the next tranche of the financing. Although we believe the expectations reflected in our forward looking statements are reasonable, results may vary, and we cannot guarantee future results, levels of activity, performance or achievements. EnGold disclaims any obligations to update or revise any forward looking statements whether as a result of new information, future events or otherwise, except as may be required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.